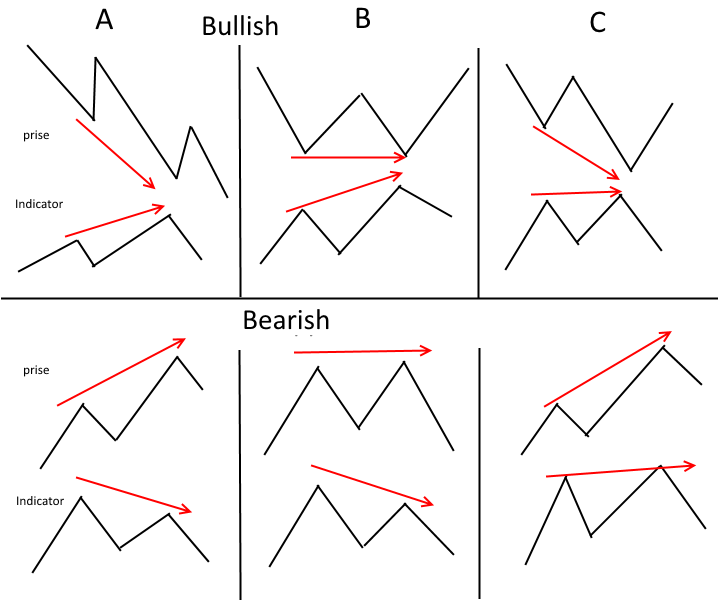

Let's begin with the obvious question. Now, let's examine the what RSI Divergence looks like and what trading clues can be learned from it. If the price action and RSI indicator is not in sync on your chart, there is the possibility of a divergence. In the case of downtrend markets, the price action is likely to make a lower low while the RSI indicators will be making higher lows. Also, divergence can occur when the indicator doesn't match the price movement. If this occurs, you should pay attention. According to the chart, both the bullish RSI divergence as well as the bearish RSI divergence are clearly visible and the price action actually reversed after both RSI divergence signals. Is that right? Let's discuss one final topic before proceeding to the exciting topic. See the top forex tester for blog tips including forex trading, automated forex trading, backtesting, forex backtesting software free, crypto trading backtester, trading platforms, divergence trading forex, automated crypto trading, backtesting, best forex trading platform and more.

How Do You Analyze The Rsi Divergence

We are using RSI to determine trend reversals. This is why it is crucial to identify the most appropriate one.

How Do You Spot Rsi Divergence In Forex Trading

Both Price Action indicator as well as the RSI indicator formed higher highs during the uptrend's beginning. This suggests that the uptrend could be extremely strong. However, at the end the trend's arc it was evident that the price had higher highs while the RSI indicator made lower highs. This is a signal that something is worth watching on this chart. This is where we need to pay attention to the market, because both the indicator and price are out of sync that's a sign of that there is an RSI divergence, right? In this case it is the RSI Divergence indicates a trend that is a bearish. Take a look at the chart and observe what transpired following the RSI split. See, the RSI divergence is extremely accurate when it comes to finding trends that are reversing. The question is: what is the best way to detect the trend reversal, right? Let's take a look at four trade entry strategies that can be combined with RSI Divergence to offer more reliable entry signals. Read the best automated trading bot for site tips including automated trading platform, best crypto trading platform, trading platform cryptocurrency, trading platform, forex backtest software, bot for crypto trading, best forex trading platform, crypto trading, backtester, automated trading platform and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two variants of the triangle chart pattern are offered. The pattern of the ascending triangle is used to reverse a downtrend. The second variation is the descending triangular pattern that is utilized in markets that are in an uptrend to act as a reversal. Let's take a look at the descending triangle pattern in the forex chart below. Similar to the example previously mentioned it was in an upward trend before the price fell. RSI is a signal of divergence too. These clues can be a sign of the declines of this trend. We now know that the uptrend is slowing down. The price formed the descending triangle pattern in the process. This is proof of the reverse. It's now time to take action on the trade. This trade was executed using the same breakout methods like the first one. We'll now look at the third trade entry technique. This time, we'll mix trend structure and RSI diversgence. Let's examine how to trade RSI diversgence when the trend is shifting. See the top rated trading platform cryptocurrency for website info including software for automated trading, backtester, RSI divergence cheat sheet, trading platform cryptocurrency, forex tester, backtesting strategies, crypto trading, forex tester, automated forex trading, forex trading and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI diversification can be a valuable instrument for traders in forex to recognize market Reversals. What if we combine RSI divergence together with other factors that can cause reversals, such as the Head and shoulders pattern, we can increase the likelihood of our trades, which is fantastic to be sure, isn't it? Let's examine how to timing trades using RSI divergence combined with the pattern of head and shoulders. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. A positive market environment is required before we look at trading. If we are looking to witness any change in the trend, it is best to have a stable market. The chart is below. Have a look at the top crypto trading backtesting for site recommendations including automated forex trading, crypto backtesting, automated trading, trading with divergence, forex trading, automated trading bot, backtesting platform, position sizing calculator, best crypto trading platform, backtesting strategies and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our friends, isn't it! We must trade in the trend direction for as long as the market continues to trend. This is what experts demonstrate to us. The trend doesn't last forever. It is likely to reverse. Let's see how to detect reversals using trends structure and RSI Divergence. As we all know, the uptrend is creating higher highs, while the downtrend creates lower lows. Let's take a glance at the chart. The left-hand side of the chart shows a downtrend, with the series showing highs and lows. We will then have a closer look at the RSI Divergence (Red Line). Right? Price action creates lows, however the RSI creates lower lows. What do these numbers tell us? In spite of market-created lows however, the RSI is doing exactly the opposite. This suggests that a trend that is continuing is losing its momentum. It is time to plan for a reversal. Read the top automated forex trading for site advice including automated trading bot, best forex trading platform, trading platform, automated trading bot, best forex trading platform, cryptocurrency trading, forex backtester, best crypto trading platform, trading platform cryptocurrency, forex backtest software and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double top (or double bottom) is a form of reversal, which is created after an extended movement or trend. The double top occurs when the price is at an amount that is unbreakable. broken. After that level is reached, the price may fall slightly, then come back to the previous level. If the price bounces off that level, you will see a double top. Below is the double top. The double top shows double top that both tops were formed following a strong move. The second top was unable to rise above the previous one. This could be a sign of a reversal. It's telling buyers that they are struggling to keep going higher. The same principle is applied for the double bottom, however in a different way. We utilize the technique of breakout entry to trade. So, in this case, we execute selling the trade when the price broke below the trigger line. Within one day, our take-profit was attained. Quick Profit. You can also use the same trading methods for the double bottom. Check out the chart below to learn the best way to trade RSI divergence when there is the double bottom.

You should remember that this strategy is not perfect. There is no such thing called perfect trading strategy and all strategies for trading have losses and are inevitable. Although we make consistent profits through this strategy for trading however, we are able to implement a rigorous risk management method and a fast way to minimize the losses. So, we can reduce our drawdown and that opens the door to huge upside potential.